By Simon Khalaf, SVP of Publisher Products

On June 29th Bank of America released the findings of its second annual report on Consumer Mobility. The report showed that the US population is perpetually plugged-in with 71% of those surveyed disclosing they actually sleep with their smartphones. This prompted us to revisit the study we conducted in Q2 of 2014 in which we first uncovered the rise of a new breed of mobile users: the Mobile Addicts.

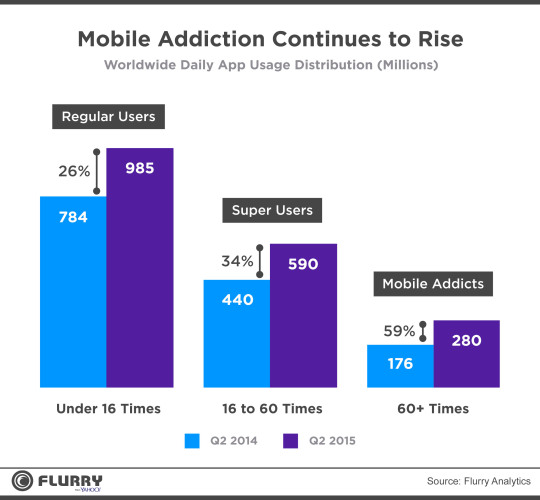

Worldwide Mobile Addicts Grew 59% in the Last Year

The chart below shows the results of the new research. It is clear from that chart that the trend Bank of America is talking about is not limited to the United States. In fact, that trend is global. From Q2 2014 to Q2 2015, the total population of smart devices measured by Flurry grew from 1.3B to 1.8B, a 38% year over year growth. Regular Users, consumers who use apps between once and 16 times daily, grew from 784 million to 985 million in the same period, a 25% increase. Super Users, consumers who use apps between 16 and 60 times daily, grew even more in that same period from 440 million to 590 million, a 34% increase.

When we looked at Mobile Addicts, consumers who launch applications 60 times or more per day, we saw this group is growing at the fastest rate, from 176 million in Q2 2014 to a whopping 280 million in Q2 2015, a 59% increase.

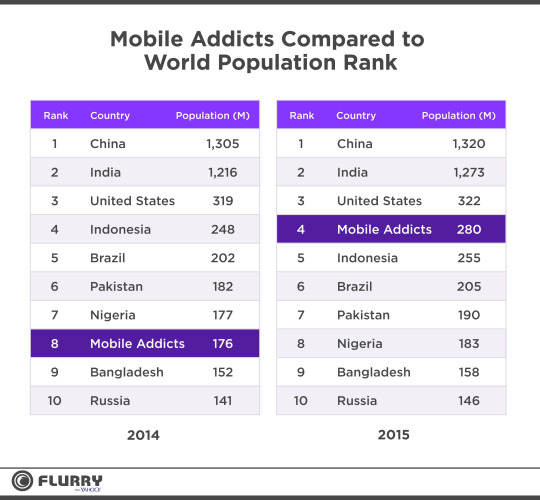

The Nation of Mobile Addicts would be the World’s Fourth-Largest

Just to put things in perspective, if the number of Mobile Addicts there were in 2014 had been the population of a country, such country would have been the 8th largest in the world last year, slightly below Nigeria. In 2015, the growth of the Mobile Addicts population would have propelled that country to the 4th spot, just below the United States and ahead of Indonesia. It is hard to imagine a country can expand that fast in one year, but Mobile Addicts have.

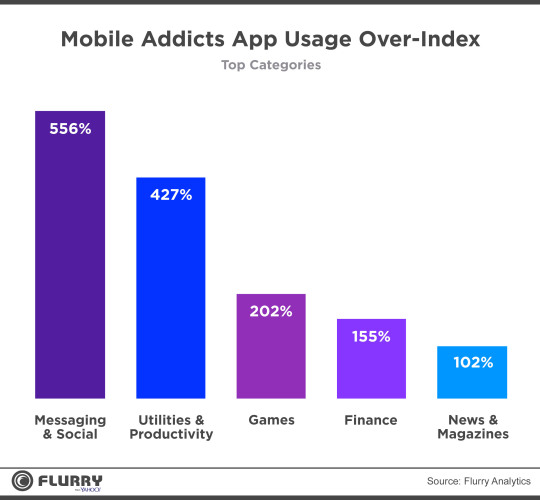

Mobile Addicts Driven by Messaging and Social Apps

To help us better understand Mobile Addicts, we looked at the categories of applications they are using and found that Mobile Addicts usage over-indexed in all categories. So we simply focused on the top five categories, in which usage by Mobile Addicts over-indexed by more than 100% (which means that Mobile Addicts used apps in these categories more than 2 times that of average mobile consumer). The results are shown in the chart below.

Messaging and social apps are clearly the leading apps used by Mobile Addicts. In fact, Mobile Addicts use Messaging apps 6.56 times (an over-index of 556%) more than an average mobile consumer. This validates many of our analyses this year that messaging has become mobile’s killer application. Utilities and Productivity app usage was high as well, further validating our assumptions that Mobile Addicts are using their smart device as the sole computing device and conducting every aspect of their lives on that device. Please note that keyboard apps and web browsers are included in that category and have contributed to the fascinating growth in that category’s usage. But the largest contributors to growth are productivity apps, especially among college students which are part of Mobile Addicts as per our research last year.

Games, News, Media and Entertainment apps are also a big hit among Mobile Addicts but that was not a surprise to us. In fact, we believe that the only newspaper Mobile Addicts have touched is actually on a mobile app.

We were most surprised by the finance category. Mobile Addicts use finance apps 2.5 times more than the average mobile consumer (an over-index of 155%). This further validates findings by Bank of America that 48% of their consumers are active app users. This is an astounding finding given that Bank of America’s history dates back to 1904 and in just 8 years almost 50% of its consumers changed banking habits.

The mobile industry is moving fast. It is actually hard to believe that Mobile Addicts are now 280 million strong and even harder to predict what their number will be next year. One thing is clear though, Bank of America’s founders didn’t plan that 111 years after the creation of their bank, half of its consumers will only visit one branch—the one in their pocket.